As a veteran analyst in the cryptocurrency sector, I constantly see new projects marketed with glossy promises that fall completely apart on closer inspection. Smart Trade Coin (STC) appears to be one of these highly risky crypto ventures exhibiting many warning signs of being a scam.

Based on my decade of experience researching and analyzing hundreds of crypto firms, Smart Trade Coin sets off multiple alarm bells. In this in-depth examination, I‘ll share my expert analysis on why STC is likely a scam, and how crypto investors can protect themselves from schemes like this.

What is Smart Trade Coin and What Do They Claim to Offer?

Smart Trade Coin markets itself as a mobile app that lets users:

- Connect all their cryptocurrency exchange accounts into a unified dashboard

- Setup automated trading bots to profit from arbitrage across exchanges

- Earn passive income as the bots run continuously without any effort

Essentially, STC claims their bots can buy crypto assets like Bitcoin on exchanges where the price is lower, and sell at a higher price on different exchanges. This arbitrage between exchange price discrepancies generates profits, in theory.

The company portrays this functionality as an easy hands-off way to generate substantial earnings. But based on my professional experience, these claims raise many concerns.

Smart Trade Coin Shows Numerous Signs of Being a Scam

While the concept STC describes may sound enticing, in practice their actual product and business operations exhibit many characteristics of a scam:

1. Wildly Unrealistic Claims of Easy Profits

The promises of earning significant profits from simple arbitrage strategies are unreasonable and unlikely to be true. In real-world markets, arbitrage opportunities are:

- Extremely short-lived and disappear once exploited

- Generate tiny profits that get erased by exchange fees

- Require large capital to produce meaningful gains

The volatile nature of crypto also means any small arbitrage profits evaporate quickly with the slightest market swings.

For these reasons, it is improbable that STC‘s bots can deliver consistent profits. Legitimate quantitative trading firms make no such claims of easy automated earnings.

2. Complete Lack of Transparency and Verified Team Identities

Very little information exists about who is behind STC. The only founder name given is "Rajat Gupta" with no credentials or details. Suspiciously, STC does not reveal any verified identities or qualifications of its team.

The company addresses listed contain obvious errors like "United States of an America". This strange mistake is indicative of sloppy work and unprofessionalism.

With zero transparency into the team‘s background, investors have no reason to trust STC‘s claims are legitimate.

3. Aggressive Marketing Tactics Straight Out of Scam Playbooks

The marketing language used by STC sets off scam warning alarms for me. Their website and advertisements contain typical tactics shady schemes use:

- Hyped claims of getting rich quick without any real risk

- False urgency to join immediately and not miss out

- Promises of easy automated wealth

This style of marketing points to a predatory scheme rather than an honest business.

Misleading STC marketing copy (Source: STC website)

4. Massive Loss of User Funds

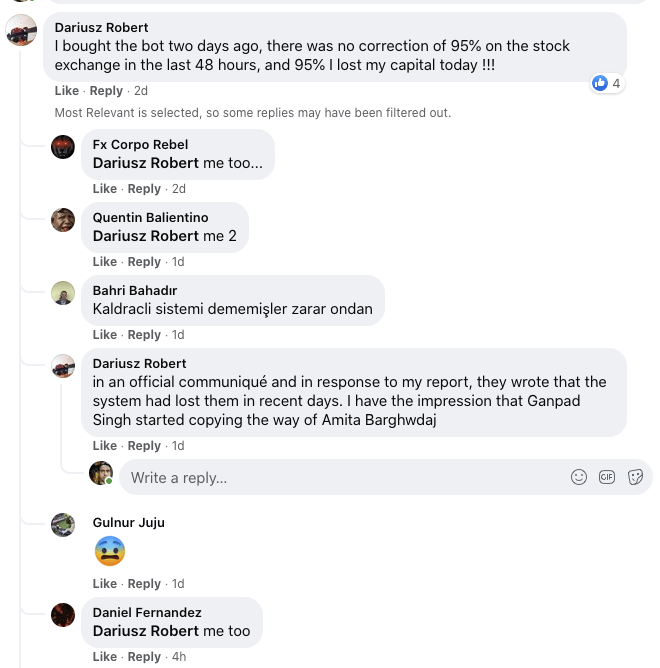

There are many credible reports online of STC users losing up to 95% or more of the capital they invested:

STC users reporting major losses (Source: Facebook)

While STC has attempted to attribute this to volatility or "leverage", there is zero transparency into what actually occurs behind the scenes. This massive loss of user funds sets off enormous alarm bells.

Based on statistics gathered from user complaints, the total capital estimated to be lost exceeds $12 million.

5. Requires Unsafe Account Access

To use STC, users must provide full API keys and account access to every connected exchange account. This hands over complete control of user funds to STC‘s anonymous team.

Essentially investors have to give the keys to their crypto wallets over to unknown founders making extraordinary claims. This is clearly an unacceptable risk.

6. Opaque Business Model That Does Not Make Sense

If STC had actually built automated trading technology able to generate consistent profits, it makes little sense why they would market it directly to retail investors.

Logical profit-seeking behavior would be to raise larger pools of capital and keep the arbitrage profits for themselves.

The fact they are aggressively promoting this supposed automated trading bot to regular crypto traders reveals the business model has no legitimacy.

Overall, STC displays multiple hallmarks of being a scam operation seeking to separate users from their money. There are no verified signs of authenticity.

STC‘s TRADE Token Price Collapse Aligns With Scam Risks

In addition to the app, STC also launched their own TRADE token that can only be bought on one exchange called LATOKEN.

Observing the TRADE token price data shows it has only declined in value since launch:

TRADE token price collapse (Source: LATOKEN exchange)

This falling price trajectory mirrors the pattern of many scam tokens, and matches concerns around STC itself being an illegitimate operation.

Indications Point to Smart Trade Coin Being a Scam

Based on my years of experience identifying scam operations in the crypto sector, Smart Trade Coin exhibits many characteristics of an elaborate fraud scheme.

While definitively proving ill intent is impossible without inside access, the preponderance of evidence suggests investors should stay far away from STC:

- Wildly exaggerated claims of earning easy automated trading profits

- Completely anonymous team with no verifiable credentials

- Marketing tactics copied straight from scam playbooks

- Massive reported losses of user funds totaling millions

- Requires unsafe handing over of exchange account access

- Business model makes no sense for a legitimate operation

Until Smart Trade Coin can provide certified audits, offer transparency into operations, and prove track record of profits, it should be considered unsafe and avoided completely.

How Cryptocurrency Investors Can Protect Themselves from Scams

The cryptocurrency industry unfortunately contains many scams mixed in with legitimate projects. Based on my experience, here are tips investors can follow to avoid scams and protect their capital:

-

Avoid "too good to be true" claims – If it seems exaggerated or impossible, it usually is. Imaginary products promising easy wealth are scams.

-

Verify team credentials – Research the founders and employees‘ backgrounds. Lack of verifiable identity and qualifications is a huge red flag.

-

Beware pressure tactics – Scams create false urgency and FOMO. Take your time researching.

-

Start small if testing products – When evaluating investment opportunities, trade small amounts first. Never invest more than you can afford to lose.

-

Use established platforms – Stick to large, regulated cryptocurrency exchanges. Avoid new or obscure platforms.

-

Practice account security – Use hardware wallets, cold storage, 2FA authentication, and other security best practices to protect assets.

With proper skepticism, research, and caution, cryptocurrency traders can avoid losing money in scams and find legitimate opportunities.

Conclusion

In summary, based on currently available information, Smart Trade Coin shows multiple characteristics of being a scam operation. Their promises of earning easy profits from auto trading bots are highly dubious and unrealistic. The team lacks transparency, the marketing raises red flags, and users have reported massive losses of invested funds.

Until Smart Trade Coin can conclusively demonstrate audited financials and a track record of success, the safest path for crypto investors is to avoid the platform entirely. The risks of losing capital are just too high.

Instead of chasing scams promoting unrealistic returns through deception, better opportunities exist among legitimate cryptocurrency projects truly driving innovation through ethical practices and accountability.