Non-fungible tokens (NFTs) have evolved from a niche concept to one of the most talked about technologies across industries. As per Statista, the global NFT market is projected to reach over $80 billion by 2030.

NFTs are digital assets verified by blockchain technology, each with a unique signature making them non-interchangeable. Their programmable nature allows embedding metadata like ownership records, traits, royalties, and transfer rights.

Initially associated with collectible artwork, NFT applications now span diverse sectors, providing new revenue streams and business models. As per NonFungible‘s 2022 report, the top NFT categories are art, sports, gaming, metaverses, and utilities.

This article explores the top 10 NFT use cases gaining traction in 2024:

1. Music

The music industry is ripe for NFT disruption. Artists can now tokenise their songs, albums, merchandise, and other assets. Fans can directly support them through exclusive experiences.

As per MusicWatch study, 15% of Americans own music NFTs. The market grew to $2.5 billion in 2024.

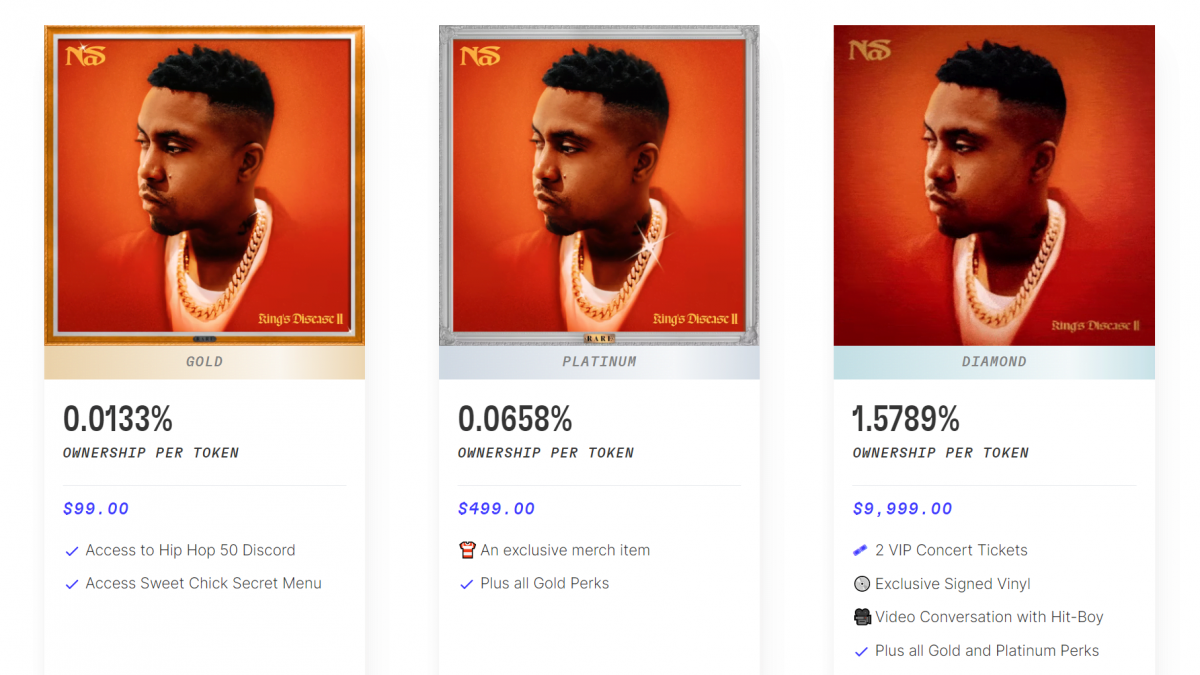

For instance, Grammy-winning rapper Nas sold NFTs for his songs Ultra Black and Rare in partnership with Royal platform. The multi-tiered NFTs grant royalty shares and special benefits based on rarity.

Such music NFTs enable:

-

Direct revenue: Artists earn from initial sales and royalties.

-

Engagement: Fans get limited edition collectibles and VIP access.

-

Control: Artists retain ownership rights.

-

Transparency: Automated royalty distribution via smart contracts.

2. Fashion

Digital fashion is surging both as collectibles and utility for virtual worlds.

As per DappRadar, fashion NFT trading volume crossed $8 million by 2021-end. Even high-end brands like Dolce & Gabbana, Gucci, Louis Vuitton have entered the metaverse through NFTs.

For instance, RTFKT Studios sold clone-themed sneakers as NFTs for over $3.1 million. Owners got both virtual and physical shoes.

Benefits of fashion NFTs:

- Digital-only collectibles for virtual worlds.

- Combined digital and physical wares.

- Fight counterfeits via blockchain verification.

- Community engagement for brands.

3. Gaming

Gaming drives major NFT traction with play-to-earn models and in-game assets.

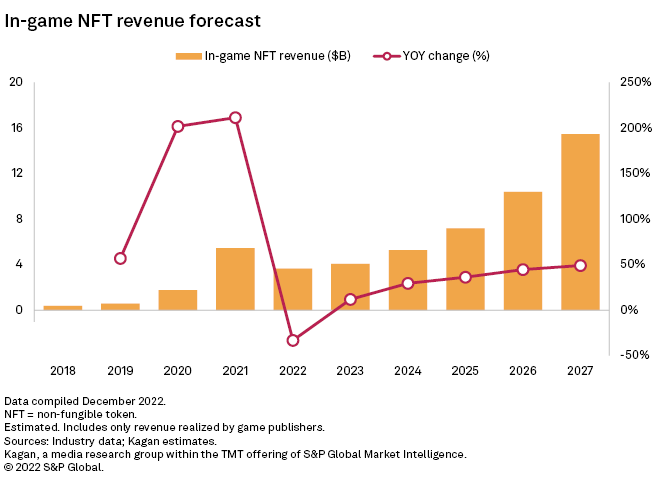

The gaming NFT market will likely surpass $15 billion by 2027 as per S&P Global (see chart below). Leading play-to-earn games like Axie Infinity and Splinterlands are already clocking millions in revenue.

However, traditional gaming firms like Steam and Xbox remain wary of blockchain games over volatility and scams. Ubisoft halted its NFT plans due to poor sales. The space remains nascent and speculative.

Benefits of gaming NFTs:

- Play-to-earn model for players.

- New revenue stream for developers.

- Facilitates player-driven economies.

- Verifiable scarcity for in-game assets.

4. Luxury Goods

Luxury brands dealing in high-value goods can leverage NFTs to prove authenticity and track provenance.

For instance, LVMH joined the Aura blockchain consortium to provide certified luxury goods. Each NFT will include product origins, sustainability scores, repair/recycle options etc.

Similarly, NFTs enable tracing ethical sourcing and fair labour practices via supply chain transparency in sectors like diamonds, coffee, fashion etc.

Benefits of luxury goods NFTs:

- Establish authenticity and prevent counterfeiting.

- Track origins and lifecycle histories.

- Promote sustainability and ethics.

- Enable responsible recycling/disposal.

5. Metaverse

The metaverse couples virtual worlds, augmented reality, and blockchain economies. Analysts predict the market will grow 56x in the next few years.

Real estate forms a major NFT use case in metaverse platforms like Decentraland and The Sandbox. People are already buying virtual land parcels as NFTs for millions. Brands like Adidas and Atari are purchasing space.

Benefits of metaverse NFTs:

- Purchase virtual goods and land.

- Design customisable avatars.

- Access exclusive virtual events, galleries etc.

- Experience web3 dynamics early.

6. Supply Chain Management

NFTs are invaluable for improving transparency in supply chain operations.

When production inputs or outputs are tokenized, the entire journey from origin to destination can be traced immutably. This enhances security, accountability, and coordination.

For instance, Moyee Coffee in Ethiopia is tokenizing its coffee beans via NFTs to track bean varieties all the way till brewing by consumers. Customers can scan QR codes to view this trail.

As an expert in data analytics and extraction, I foresee NFTs enabling powerful new data capture and sharing capabilities across supply chains:

-

Real-time monitoring: NFTs can transmit sensor data like temperature, humidity, shipments in transit etc. for real-time monitoring.

-

Predictive analytics: The data trails from NFTs can feed complex forecasting models to predict delays, waste etc.

-

Legacy system integration: NFT data can seamlessly integrate with existing enterprise systems like ERPs.

-

Selective transparency: Permissioned access to NFT data provides transparency without compromising privacy.

Benefits of supply chain NFTs:

- End-to-end tracking of assets.

- Prevent tampering via blockchain ledger.

- Promote sustainability and ethics.

- Build customer trust and loyalty.

7. Ticketing

NFT-based ticketing solutions are tackling chronic issues like scalping, fraud, lack of royalties etc.

Platforms like Yellowheart allow artists like The Weeknd to sell tickets directly to fans. NFT ticket holders can securely trade or resell peer-to-peer.

Such web3 ticketing ensures:

- No fake tickets or bots scooping up inventory.

- Curb ticket scalping and unfair pricing.

- Royalty shares for organizers on secondary sales.

- Special perks for ticket holders.

- Prevent unauthorized reselling via binding to buyer‘s wallet.

Research shows NFT ticketing could unlock $230 billion in value for the live events industry.

8. Asset Tokenization

NFTs enable fractional ownership of tangible assets – both digital and physical – thereby improving liquidity.

For instance, NeftyBlocks allows synthesizing real estate properties into NFTs. Minimum buy-in reduces from millions to a few hundred dollars.

Benefits of asset tokenization:

- Fractionalize ownership of high-value assets.

- Improves liquidity and access for investors.

- Token holders get rental income shares etc.

- Immutable record of asset ownership history.

- Around-the-clock global trading.

9. Identity and Credentials

NFTs present a decentralized approach to manage digital identity and credentials securely.

Educational institutes can issue diplomas and certifications as NFTs. It enables verifiable claims of credentials and achievements.

Similarly, governments can enable citizens to own their personal records – from ID cards, driving licenses, to health records – as NFTs.

Benefits include:

- Tamper-proof and owner-managed system.

- Share/verify credentials while maintaining privacy.

- Reduce identity theft and fakes.

- Cross-border portability of credentials.

10. Lending & Collateralization

NFTs themselves are becoming collateral for decentralized lending in DeFi protocols.

Borrowers can obtain loans by staking high-value NFT assets like CryptoPunks or Bored Apes as collateral. If payments are missed, the NFTs can be liquidated.

For lenders, such NFT-backed loans provide excellent recovery mechanisms. Moreover, borrowers don‘t need to liquidate their NFT holdings to access capital.

Benefits include:

- Alternative collateral model beyond cryptocurrencies.

- Enable NFT holders to unlock their value.

- Competitive interest rates for borrowers.

- Strong recovery mechanisms for lenders.

NFT adoption is still in early stages. Beyond the hype and inflated valuations, real-world utility will determine long-term traction. Their programmable and verifiable nature opens up new horizons to reimagine models across industries.

How these diverse NFT applications evolve remain to be seen. But their unique digital ownership capabilities will likely transform many markets that rely on proof of authenticity and scarcity.