NFTs (non-fungible tokens) took the world by storm in 2021 with over $23 billion in trading volume as per DappRadar‘s 2021 Industry Report. While the craze has cooled down in 2024, NFTs are here to stay as businesses and individuals continue to explore the possibilities of this new technology.

An NFT marketplace is required for anyone looking to buy, sell or create NFTs. However, with so many options available, how do you choose the right NFT marketplace for your needs?

In this comprehensive guide, we will analyze the top 16 NFT marketplaces of 2022 based on several key factors to consider:

Supported Blockchains

NFTs are primarily minted and traded on blockchain networks. Ethereum has been the dominant blockchain for NFTs, but its market share dropped from 95% to 80% in early 2021 as newer chains like Solana gained traction.

When selecting an NFT marketplace, check which blockchains it supports as you will typically not be able to transfer NFTs across chains easily.

We evaluated blockchains on parameters like security, scalability, transaction fees, overall crypto trading volume and NFT trading volume specifically. Here‘s a quick snapshot of our analysis:

- Bitcoin & Stacks: Highest security, scalability potential and low fees but very low NFT volume

- Ethereum: Pioneer NFT chain but high fees and scaling issues

- Solana: Fast and cheap but sacrifices decentralization for speed

- Polygon: Ethereum sidechain for faster and cheaper transactions

- Flow: Developed specifically for NFTs by Dapper Labs

For a detailed analysis of top NFT blockchains, refer to our guide on Top 3 Blockchains for NFTs.

Sales Volume

Trading volume indicates the liquidity and diversity of NFTs available on a marketplace. Higher volume platforms typically have more buyers and sellers.

In Q1 2022, OpenSea led with a massive $3.5 billion volume across Ethereum, Polygon and Solana followed by LooksRare at $1.8 billion.

However, volume isn‘t the only metric for diversity since some marketplaces like SuperRare focus exclusively on art NFTs.

For blockchains like Ethereum with multiple marketplaces, you need to analyze market share per chain.

As per DappRadar‘s all-time volumes, OpenSea leads on Ethereum while MagicEden tops on Solana. Stacks volume data from Stacks on Chain shows Gamma as the leader.

Optimally, you want to list your NFTs on the top marketplace for that blockchain to access the majority of buyers and sellers.

NFT Types

NFT use cases have expanded beyond collectibles like profile pictures and trading cards. You can now find NFTs for arts, music, videos, metaverse assets, domain names, event tickets and more.

Some NFT marketplaces support diverse asset types while others focus on a specific niche like arts or gaming.

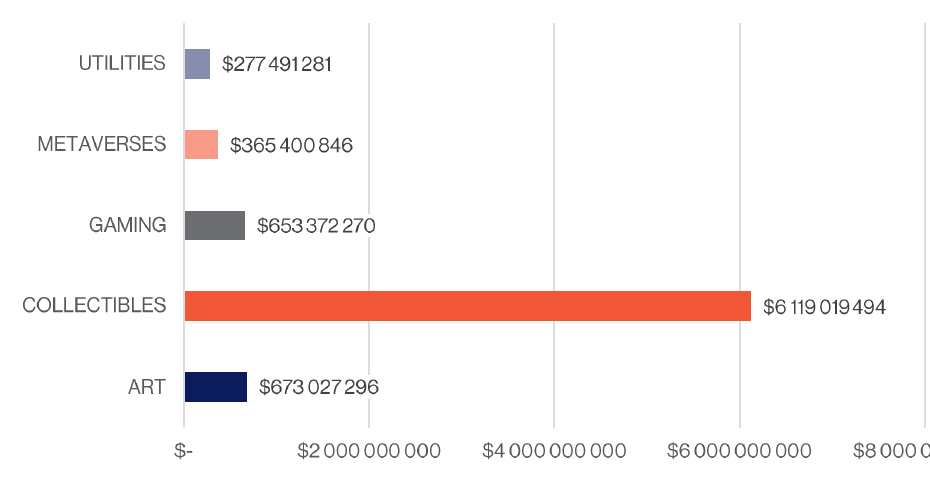

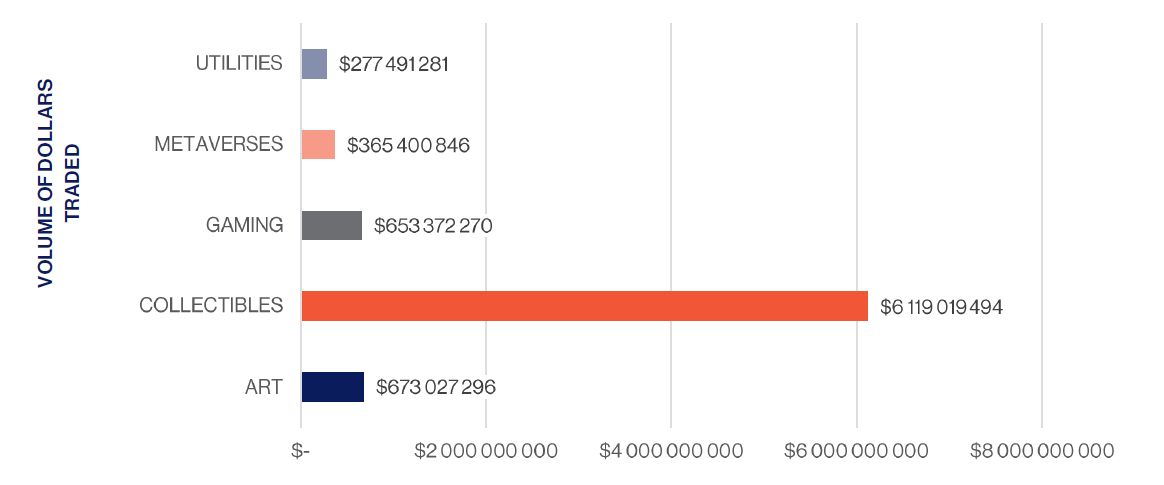

As per NonFungible‘s 2022 Q1 report, collectibles lead NFT volumes followed by art, gaming and metaverse. Select a marketplace suitable for your NFT type.

Fees

NFT platforms charge a range of fees, including:

-

Blockchain transaction fees: Required to mint NFTs and can vary from a few cents on Solana to $50+ on Ethereum. Some platforms cover gas.

-

Service fee: Marketplace commission charged on sales, typically 2-5%.

-

Royalties: Paid to creators each time their NFT is sold. Up to 10% on most platforms.

Ethereum‘s high and unpredictable gas fees are especially problematic for NFT creators and traders. Choose platforms that subsidize gas to improve affordability.

Top 16 NFT Marketplaces 2023

With the key factors explained, let‘s analyze the top NFT marketplaces of 2023. The list is sorted by 30-day volume and covers major blockchains like Ethereum, Solana, Flow and new players like Stacks.

| Marketplace | 30D Volume | Blockchains | Categories | Fees | Fiat Support | Cryptos | Royalties |

|---|---|---|---|---|---|---|---|

| Gamma | $300K | Stacks | Art, Collectibles | Incl. in price | ❌ | STX | ✅ |

| OpenSea | $3.5B | Ethereum, Polygon, Solana, Klaytn | Collectibles, Utility, Art, Metaverse | 2.5% | ✅ (Limited) | ETH, MATIC, SOL, USDC | Max 10% |

| LooksRare | $1.8B | Ethereum | Collectibles, Utility | 2% | ❌ | ETH | ✅ |

| Magic Eden | $298M | Solana | Collectibles, Utility, Gaming, Metaverse | 2% | ❌ | SOL | ✅ |

| CryptoPunks | $54M | Ethereum | Collectibles | 0% | ❌ | ETH | ❌ |

| Axie Infinity | $38M | Ethereum, Ronin | Collectibles, Gaming | 5.25% | ❌ | ETH | ❌ |

| NFTrade | $17M | Ethereum, Polygon, BSC, Avalanche, Moonriver, Moonbeam | Collectibles, Gaming | 0% | ❌ | ETH, MATIC, BNB, AVAX, MOVR, GLMR | ✅ |

| NBA Top Shot | $18M | Flow | Collectibles | 5% | ✅ | BTC, ETH, USDC | ❌ |

| Blocto Bay | $38M | Flow | Arts, Gaming, Collectibles | – | – | FLOW | – |

| MOBOX | $17M | BNB Chain | Gaming | 5% | ❌ | BNB, MBOX | Planned |

| AtomicMarket | $7.5M | WAX | Collectibles, Trading Cards | 2% | ❌ | WAX | ✅ |

| Rarible | $3M | Ethereum, Flow, Tezos, Polygon | Collectibles, Art, Metaverse, Utility | 2.5% buy & sell | ✅ | ETH, FLOW, XTZ, MATIC | Max 50% |

| Foundation | $2.6M | Ethereum | Art | 5% | ❌ | ETH | 10% |

| Solanart | $1.6M | Solana | Collectibles, Gaming, Metaverse | 3% | ❌ | SOL | ✅ |

| SuperRare | $200K | Ethereum | Art | 15% first sale, 3% subsequent | ❌ | ETH | 10% |

| Nifty Gateway | – | Ethereum | Art, Collectibles | 15% | ✅ | ETH | ✅ |

*30D volume as of 17/05/22 from DappRadar

**Based on data from Stacks on Chain and Binance

Key Takeaways

-

Assess blockchain support carefully as moving NFTs across chains is difficult currently.

-

Opt for the top marketplace on your blockchain for maximum liquidity and reach.

-

Consider niche-focused platforms if dealing with specific NFT types like arts.

-

Watch out for fees like gas, platform commissions and royalties when pricing NFTs.

-

Explore platforms offering fiat onboarding and free gas to improve affordability.

Conclusion

The NFT space is constantly evolving with new platforms, chains and use cases. By evaluating marketplaces across key parameters like volume, blockchain support, fees and asset types, you can make an informed choice tailored to your specific needs.

At the same time, don‘t just chase short-term trends. Assess long-term traction to ensure the sustainability of the marketplace as the NFT ecosystem matures.