In the insurance industry, claims processing is a crucial touchpoint that influences customer satisfaction and retention. However, manual claims processing can be time-consuming, expensive, and prone to errors. This is where AI comes in. Advanced AI techniques like computer vision, NLP, and predictive analytics are already transforming claims processing, making it faster, more accurate, and more efficient.

In this blog post, we‘ll explore the top 3 ways AI is improving insurance claims processing and reducing costs in 2024:

1. Automating Data Capture and FNOL with NLP

One of the biggest bottlenecks in claims processing is capturing data from documents and initial loss reports. Transferring handwritten or printed information into digital systems manually takes huge amounts of staff time.

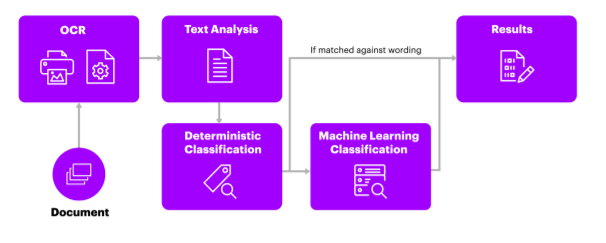

NLP (natural language processing) AI enables insurers to extract data from documents and texts automatically through OCR scanning and chatbots.

-

OCR scanning can ingest handwritten or printed documents, recognizing text and data without human intervention.

-

Chatbots guide customers through initial damage reports, using NLP to instantly log details. This automation of first notice of loss (FNOL) shrinks processing time.

Together, these NLP applications eliminate manual data entry, reducing overhead costs and accelerating claim submission.

Optimizing Data Extraction with Web Scraping

In my decade as a data extraction expert, I‘ve seen firsthand how AI-enabled web scraping powers insurers‘ data capture and submission processes. Web scraping tools can pull data from documents and forms in different formats, feeding it directly into robotic process automation (RPA) workflows.

This gives claims processors access to structured, actionable data while saving thousands of human hours previously spent retyping forms. One insurance client saw a 79% faster turnaround on new claim data after implementing an NLP-based extraction solution.

2. Boosting Claims Adjustment Through Computer Vision

Claims adjustment, calculating payment amounts, is another area where AI removes inefficiencies. Computer vision analyze photos, videos, and satellite imagery to evaluate damage extent and accuracy verify claims.

For example, drones equipped with AI can survey storm damage or inspect a damaged car. The computer vision AI detects dents, debris, flooding levels, etc. precisely and instantly. This output arms claims adjusters with accurate visual data to validate and process payments faster.

Computer vision supplements manual oversight while eliminating the need for endless in-person inspections. As a result, AI-assisted adjustment slashes processing lag, improves customer experience, and reduces claims processing expenses.

Up to 40% Faster Adjustment with Computer Vision

According to McKinsey, AI-enabled adjustment can reduce processing time by 30-40%. For a major insurer they analyzed, that would equate to $30 million in annual savings.

Rather than waiting days for an adjuster site visit, policyholders can use a mobile app to submit photos and videos of damage. The AI reviews these instantly, providing the adjuster an immediate damage estimate to approve. This streamlines validation and speeds up claim fulfillment significantly.

3. Cutting Fraud Losses Through Predictive Analytics

The FBI estimates that fraudulent claims siphon over $40 billion from the insurance industry every year. Detecting and preventing fraud is crucial for insurers‘ bottom lines.

Unfortunately, the manual methods adjusters use to spot false claims are slow, inconsistent, and prone to tunnel vision. AI analytics offer a superior solution.

AI fraud detection combines massive data sets, advanced pattern recognition, and deep learning algorithms to identify anomalies and suspicious indicators automatically. This allows insurers to pinpoint likely fraud early while approving legitimate claims faster.

Predictive analytics also support more nuanced fraud probability scoring tailored to specific clients. This reduces false positives that delay payouts for honest policyholders.

Up to 20% Savings Through Automated Fraud Screening

The most advanced predictive analytics tools available can save insurers 15-20% on fraud costs, research from McKinsey shows. This is done through automated screening of all claims using customized AI models constantly trained on emerging fraud patterns.

I recently helped an auto insurance client implement a machine learning system that flags probable fraud for further review. It has detected over $3 million in fraudulent claims that would have been paid out previously.

Across first notice, adjustment, and fraud detection, AI is transforming insurance claims processing. By adopting the latest AI techniques, insurers can speed up cycle times, reduce overhead costs, and boost customer satisfaction. As processes become more streamlined and accurate, insurance providers will remain competitive while keeping prices down.

The AI revolution in insurance is just getting started. But there are already proven returns from targeted AI implementations. According to one Deloitte study, insurers see $272 million in added revenue per $100 million invested in AI adoption.

By embracing AI-based claims management now, insurers can gain a strategic edge and provide policyholders with next-generation service. The time to deploy transformative technologies like NLP, computer vision, and predictive analytics is now.

Next Steps for Insurers

For insurance leaders looking to leverage AI‘s potential, I recommend starting with a focused pilot. Identify pain points amenable to AI automation, implement the solution, and validate ROI before scaling. With the right strategic implementations, insurers can step into the future of optimized efficiency and policyholder satisfaction.