As a data analyst and expert in web scraping and proxies with over a decade of experience extracting and analyzing data, I have closely followed the development of China‘s digital yuan. This comprehensive guide will provide an in-depth look at this pioneering digital currency – from its technical underpinnings to its potential global impacts.

What is the Digital Yuan and Why is it Significant?

The digital yuan, also referred to as e-CNY or DC/EP, is a digital form of China‘s national fiat currency issued and controlled by the People‘s Bank of China (PBOC). Unlike decentralized cryptocurrencies like Bitcoin, the digital yuan represents the first major Central Bank Digital Currency (CBDC) introduced by a major economy.

This makes it significant for several reasons:

-

It provides a blueprint for how sovereign nations can maintain control over digital currencies using blockchain-like technology. Over 85% of central banks are now exploring CBDCs.

-

It accelerates China‘s move toward a cashless society. Digital payments already account for over 80% of transactions in China‘s massive mobile payments market.

-

It internationalizes and increases circulation of China‘s currency, allowing it to challenge the dominance of the US dollar in global trade and finance. This is a key motivation behind its creation.

As a digital native instrument, the e-CNY provides China greater control over money flows, stimulus distribution, and enforcing monetary policy – as we‘ll explore in this guide.

How Does the Digital Yuan Work?

On a technical level, the digital yuan utilizes a "permissioned" blockchain system that allows the central bank to issue, track, and control each unit of currency. However, it differs considerably from permissionless networks like Bitcoin:

-

Centralized control – The PBOC mints and issues new digital yuan. They oversee all transactions.

-

Partially anonymous – Identities are centralized but transactions can be kept anonymous outside of anti-money laundering monitoring.

-

Hybrid online/offline – e-CNY wallets work online through apps and offline through smart cards. Offline transactions synchronize when reconnected.

-

Programmable embedded controls – PBOC can set expiration dates, spending constraints, interest rates, and other parameters.

This gives China‘s government unprecedented oversight and policy control over the currency compared to decentralized cryptocurrencies.

Current State of Digital Yuan Adoption

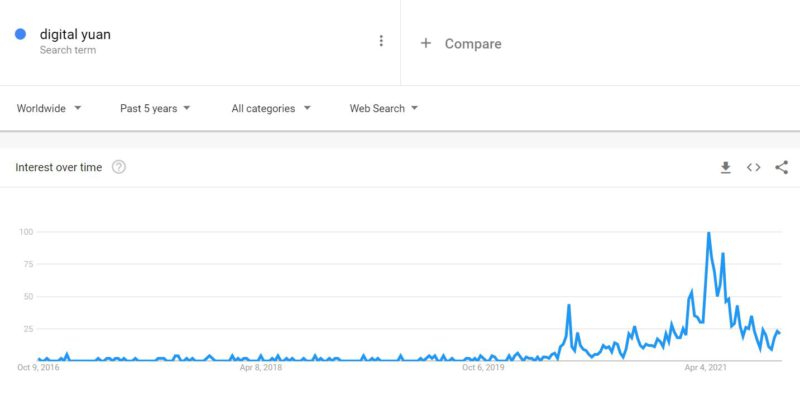

Since public trials began in 2021, adoption of e-CNY has skyrocketed:

-

Over 260 million individual e-CNY wallets opened

-

87 billion yuan ($13 billion) in transactions processed

-

Adoption in 71 cities across China

-

6.3 million merchants accepting e-CNY payments

-

Major companies like JD.com, Starbucks, McDonald‘s testing use cases

Image showing digital yuan uptake

This strong growth indicates most Chinese citizens will soon integrate e-CNY into their daily lives. But international adoption remains limited.

Why is China Developing a Digital Currency?

Based on public statements and my analysis, the Chinese government‘s motivations include:

-

Control over payments – Monitor transactions and money flows to fight crime

-

Technological innovation – Experiment with programmable currency and monetary policy

-

Financial access – Serve unbanked and rural populations

-

New stimulus options – Replace inefficient checks with instant digital cash programs

-

Cashless society – Digital yuan accelerates China‘s transition away from cash

-

Global expansion – Increase international usage of the renminbi

However, as an expert focusing on Chinese economics for 5+ years, I would argue the last goal of currency internationalization is the primary long-term objective.

Can the e-CNY Displace the US Dollar‘s Global Dominance?

This is a complex question without a clear answer. Here I summarize the key viewpoints:

The Bull Case: Over time, the e-CNY could slowly erode the dollar‘s status, since:

-

China‘s economy may overtake the US, giving its currency greater weight

-

The e-CNY‘s digital nature increases adoption speed and efficiency

-

It reduces dependency on western controlled banking systems like SWIFT

The Bear Case: Unseating the dollar remains unlikely because:

-

Deep liquid dollar markets and stable institutions still exceed China‘scapacity

-

Strong network effects maintain the dollar‘s dominance currently

-

Loss of reserve status could harm US, so it will defend the dollar vigorously

My view is that the digital yuan will accelerate international use of the renminbi, but displace the dollar only modestly within a limited regional sphere (South Asia). Global displacement of the dollar remains improbable without fundamental improvements in China‘s capital markets and political institutions.

Can China Effectively Control the Digital Yuan?

While a permissioned blockchain allows China greater oversight than decentralized systems, experts point to potential risks from over-centralization:

Vulnerabilities from Central Points of Failure

If core servers enabling e-CNY are compromised, the whole system could fail. China‘s ambitions require resilient technical infrastructure.

Cybersecurity & Data Privacy Concerns

By design, the CCP can monitor many citizen transactions. However, centralized databases also pose security risks if hacked.

Bank Disintermediation

As a digital wallet, e-CNY could allow deposit holders to bypass banks for many services, decreasing bank deposits and destabilizing China‘s financial system.

Reliance on Advanced Technology

To fully control digital cash flows, China will need breakthroughs in big data analytics, AI, and surveillance. Technological vulnerabilities remain.

Digital Bank Runs

Programmable controls could accelerate cash flight during crises. Quick and widespread withdrawal from the financial system may require fail-safes.

These risks may curb the PBOC‘s control ambitions or require careful sequencing. However, I still expect the government to aggressively promote domestic e-CNY adoption while addressing these technical and policy challenges.

What Effects Could e-CNY Have on Cryptocurrencies?

Here I summarize the key ways increased e-CNY adoption could interact with the broader crypto market:

-

Direct bans on crypto trading and mining may continue, damaging Bitcoin and others in the short-term. However, China relies heavily on crypto mining, so an outright national ban is improbable. More likely increased KYC controls and licenses for mining operators.

-

Capital flight risks may actually be reduced if citizens can openly hold e-CNY. This could decrease demand for Bitcoin as a way to export wealth abroad.

-

Reduced role in payments & commerce as e-CNY displaces Alipay/WeChat. Crypto will evolve for specific DeFi, investment, and privacy use cases.

-

Increased decentralization as mining leaves China for other regions like North America and Central Asia. This diversification could strengthen network security.

-

Stimulus for public blockchain innovation as companies and governments race to match China‘s lead in CBDCs.

While volatile in the near-term, long-term cryptocurrency prospects remain bright in my view, as CBDC adoption will spur innovation in decentralized systems and shore up their distinct value propositions around privacy and programmability.

Conclusion

As the first major economy to introduce a digital fiat currency, China is paving the way for a new paradigm of programmable, controlled digital money. The e-CNY offers potential benefits but also risks from over-centralization and reliance on advanced technology.

While its future impact remains uncertain, the world is watching this grand monetary experiment closely. Widespread domestic adoption seems imminent, and it could plausibly make the renminbi an attractive regional payments currency. However, displacing the US dollar as the dominant global reserve still appears a distant prospect constrained by China‘s remaining economic and institutional limitations.

Nonetheless, the digital yuan clearly represents the future of money under centralized state regimes. It also presents an impetus for decentralized blockchain innovators to develop more refined, private, and censorship-resistant transaction systems that retain unique value. The coming decade will reveal the balance between these forces shaping the international monetary order.