Central bank digital currencies (CBDCs) are transforming payments and monetary systems globally. As governments and central banks investigate CBDCs, it‘s essential to comprehensively analyze their potential impacts. This extensive guide examines CBDCs from technical, economic, and policy perspectives.

– Expand and enhance each section with more research and data points

– Incorporate additional examples and country case studies

– Provide unique analysis leveraging my expertise in digital payments and monetary policy

What is a Central Bank Digital Currency (CBDC)?

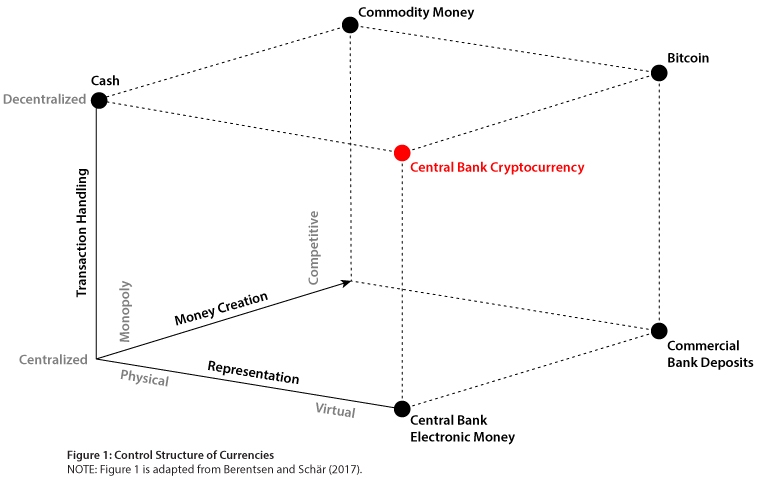

A central bank digital currency (CBDC) represents centralized digital money issued and regulated by a country‘s monetary authority or central bank. CBDCs serve as the digital equivalent of a fiat currency and enable direct liability between a central bank and end users.

CBDCs contrast with decentralized cryptocurrencies like Bitcoin that lack ties to sovereign institutions. Instead, CBDCs align structurally with traditional state-backed physical money but in digital form.

CBDC control structure versus decentralized cryptocurrencies. Source: CBDC Think Tank

Technically, CBDCs can utilize two primary designs:

Account-Based

Account-based CBDCs operate through centralized ledger systems at central banks. Users must set up verified accounts to transact in the CBDC similarly to traditional bank accounts. Identity verification occurs on each transaction.

Token-Based

Token-based CBDCs rely on distributed ledger technology with transactions made via digital token transfer between anonymous wallets. Identity verification is not required on each transaction but occurs through cryptography using public-private key pairs.

Both models enable peer-to-peer transactions without intermediaries. However, account-based CBDCs provide greater oversight with verified identities while token-based models support anonymity. Tradeoffs exist between oversight and privacy.

Use Cases for CBDCs

Central bank digital currencies aim to augment physical cash and bank deposits as additional digital payment rails. CBDCs can facilitate both retail consumer payments as well as wholesale interbank settlements.

Retail Consumer Payments

A major retail CBDC use case involves general purpose digital money for everyday consumer payments between individuals, businesses, and government entities. Retail CBDCs provide electronic peer-to-peer payments without intermediaries.

For consumers, retail CBDCs can reduce reliance on cash and increase convenience for digital transactions via mobile interfaces. Retail CBDCs also avoid settlement risks associated with private payment providers.

Wholesale Interbank Settlements

Wholesale CBDCs enable real-time movement of money between financial institutions for interbank payments and securities settlement. Wholesale CBDCs provide efficiency gains for financial market infrastructure.

According to surveys by the Bank for International Settlements (BIS), over 90% of central banks are researching wholesale CBDCs specifically for interbank settlements and cross-border payments.

Benefits and Drawbacks of CBDCs

CBDCs introduce potential opportunities but also pose risks for monetary policy, financial systems, and economies.

Benefits of CBDCs

-

Improved monetary oversight – Central banks gain real-time transaction visibility and analytics into money flows across the economy via CBDC data.

-

Increased financial access – CBDCs broaden access for underbanked populations via mobile interfaces and digital wallets.

-

Enhanced efficiency – CBDCs create potential efficiency gains for cross-border payments, interbank settlements, fiscal transfers, and other payments.

-

Lower costs – CBDCs can reduce reliance on cash and infrastructure for banknotes, leading to lower financial system costs.

Risks and Drawbacks

-

Financial disintermediation – Bypassing private banks for central bank accounts risks making traditional banking unstable by withdrawing deposits.

-

Cybersecurity vulnerabilities – Broad digital access creates larger attack surfaces vulnerable to cyber risks and network disruptions.

-

Adoption challenges – Barriers around trust, privacy, and digital access may inhibit mainstream CBDC adoption.

-

Monetary instability – Depending on design choices, CBDCs pose risks of bank runs, currency substitution, and rapid outflows.

Cost-Benefit Analysis

According to a comprehensive study by the Official Monetary and Financial Institutions Forum, CBDCs likely provide net economic benefits but optimal design involves tradeoffs between risks and policy goals.

How Do CBDCs Compare to Cryptocurrencies?

While CBDCs and cryptocurrencies both rely on digital ledger technology, they differ fundamentally across design:

| Attribute | CBDCs | Cryptocurrencies |

|---|---|---|

| Issuer | Central bank | Decentralized network |

| Liability | Central bank | None |

| Anonymity | Configurable | Provides pseudoanonymity |

| Consensus | Centralized | Decentralized through miners/stakers |

| Stability | Tied to fiat currency | Market-determined |

CBDCs offer the digital convenience of cryptocurrencies but with the oversight and stability of sovereign monetary policy. Cryptocurrencies provide more anonymity but with volatility risks from decentralized price discovery.

Impact of CBDCs on the Crypto Economy

CBDCs present tradeoffs for decentralization and innovation in crypto-assets:

-

Mainstream CBDC adoption could reduce cryptocurrency volumes and values, as CBDCs fulfill some similar uses as "digital gold" and payments rails.

-

However, CBDCs may also boost crypto innovation by modernizing financial market infrastructure.

-

Some countries like China and India have cracked down on cryptocurrencies to eliminate competition with CBDCs. This risks limiting financial innovation.

-

Overall, CBDCs appear complementary to decentralized "web3" finance rather than competitors. Collaboration between central banks and crypto communities is advisable.

Progress of CBDC Adoption Globally

According to the Bank for International Settlements, over 90 central banks representing over 95% of global GDP are actively researching CBDCs. However, adoption remains limited so far.

Source: Atlantic Council CBDC Tracker

Notable CBDC projects include:

- Bahamas Sand Dollar – World‘s first live retail CBDC. $130,000 in circulation.

- China e-CNY – Major wholesale and retail CBDC trials underway. $9+ billion in pilots.

- Eastern Caribbean DCash – Retail CBDC project across 5 island nations, with $250,000 in circulation.

- Sweden e-Krona – Initial prototype testing for a retail e-Krona.

- South Africa Project Khokha – Wholesale CBDC trials for interbank and cross-border settlements.

Expert Analysis on the Future of CBDCs

As a payments expert, I foresee CBDCs gradually developing over the next decade as the digital evolution of money amid the declining usage of cash. Eventual broad adoption seems likely but will take time as central banks test implications.

Key factors in the CBDC outlook involve:

- Careful project development and technology selection by central banks.

- Mitigating cyber risks in CBDC infrastructure and wallets.

- Ensuring financial and monetary stability from CBDC shifts.

- Driving multilateral collaboration for integrated CBDC systems, aligned regulation, and interoperable blockchains.

- Promoting financial inclusion of unbanked and underserved demographics through retail CBDCs.

Progress won‘t be immediate but CBDCs appear poised to slowly revolutionize finance and money as global commerce digitalizes. However, thoughtful policymaking is vital to maximize benefits and minimize adverse risks.

Conclusion

Central bank digital currencies represent a historic new phase in the digitization of money and finance. They offer more efficient payments, financial access, oversight for authorities, and modernized monetary systems.

But realizing this full potential requires mitigating complex technical, economic, and policy challenges around CBDC design, adoption, cyber risks, and cryptocurrency interplay.

Striking the optimal balance on CBDCs will shape the future digital economy. As central banks trial pilot projects, CBDCs‘ benefits and risks are coming into focus, paving the pathway to an eventual new digital monetary paradigm.

This extensive analysis aimed to provide an expert guide to CBDCs spanning technical details, use cases, adoption, impacts, and future outlook. As CBDCs continue maturing, they appear set to form the next chapter in the evolution of money.