Blockchain technology has transformed various industries, from finance and insurance to supply chain and healthcare. However, developing blockchain solutions requires specialized skills and knowledge. This is where blockchain APIs come in – they enable easy integration of blockchain capabilities into applications and systems.

In this post, we will explore the top 5 use cases of blockchain APIs in 2024 along with real-world examples. Drawing from my decade of experience in data analytics and integration, I‘ll provide unique insights into how businesses can leverage blockchain APIs to create impactful solutions and accelerate their digital transformation.

How Can Blockchain APIs Benefit Businesses?

Integrating blockchain technology requires understanding complex protocols, architectures, data structures and algorithms. Building customized blockchain infrastructure from scratch can be time-consuming and expensive, requiring significant initial investment.

Blockchain APIs allow businesses to plug into existing blockchain networks to extract value, without massive upfront development costs. Businesses can focus on their core solutions rather than complex distributed ledger technology.

According to a survey by Deloitte, over 55% of global executives feel that blockchain is one of the top 5 strategic priorities for their organizations. Blockchain APIs enable businesses to keep pace with this innovation in a simplified manner.

Some key benefits of leveraging blockchain APIs include:

-

Faster time-to-market: Eliminates the need to build underlying blockchain infrastructure from scratch. For example, the average time for developing a blockchain solution is 4 to 12 months. APIs can reduce it to 2-3 months.

-

Cost efficiency: Utilizes shared blockchain networks instead of deploying private chains. Setting up private chains costs ~$100,000 to millions of dollars.

-

Ease of integration: Simple REST APIs lower the barrier to integrate blockchain capabilities into existing systems. This enables adding features like payments, supply chain tracking etc. without disrupting core infrastructure.

-

Customization: Ability to build customized solutions tailored to specific business needs by manipulating API inputs and outputs.

-

Scalability: Blockchain APIs connect to established blockchain networks that already have mechanisms for scalability and throughput.

According to Capgemini, integration and maintenance costs are reduced by 30-50% by using blockchain APIs instead of developing custom solutions.

However, it‘s crucial to thoroughly test APIs before fully integrating them. Testing validates functionality, security, and performance to ensure the API meets business requirements.

Sponsored: CAST by Testifi

CAST by Testifi is an innovative codeless test automation tool. It enables teams to deliver high-quality software faster via a test-first approach. Leading companies like Amazon, BMW, and Vodafone use Testifi‘s services to ensure seamless API testing.

1. Blockchain Data Collection APIs

Blockchains contain valuable data like transaction history, account balances, network activity etc. Blockchain data APIs allow easy access to this data for analysis and display.

According to Mordor Intelligence, the blockchain data analytics market is poised to grow at a CAGR of ~23% from 2022 to 2027.

Use Case 1: Building Analytical Tools

Analysts, traders, and researchers can retrieve blockchain data via APIs to gain valuable insights. This data powers in-depth analysis, strategy development, predictive modeling and more.

For instance, on-chain data can be analyzed to study network usage patterns, identify trends, develop trading models, and derive actionable intelligence.

Use Case 2: Displaying Blockchain Information

Websites and applications can use blockchain data APIs to display information to users in a seamless manner.

For example, a cryptocurrency portfolio management system can show wallet balances, transaction history, market data and other information to customers by connecting to relevant APIs.

Example: Blockchain.com APIs

Blockchain.com offers two APIs to access Bitcoin blockchain data:

- Blockchain Data API: Provides granular data like block info, transaction details, balances, fees etc. in JSON format. Used to build analytics and financial models.

- Simple Query API: Allows simpler queries like total bitcoins in circulation, next estimated block time, average transactions per block etc. Often used to display quick blockchain stats.

These APIs power data-driven blockchain applications across industries like trading, investing, payments, and entertainment.

2. Cryptocurrency Data APIs

There are over 18,000 cryptocurrencies on the market today, with a total market cap of over $811 billion (as of Dec 2022).

Cryptocurrency data APIs provide real-time and historical pricing data, trade volumes, order book information, exchange data and more. This powers data-driven crypto products and services.

According to CryptoCompare, cryptocurrency API calls increased over 2100% from Q2 2020 to Q2 2021, indicating the soaring demand for crypto data.

Use Case 1: Building Algorithmic Trading Systems

Quantitative crypto trading funds and individuals use cryptocurrency data APIs to programmatically execute trades and implement automated trading strategies. The API data feeds the algorithms.

High frequency traders rely on real-time data and ultra-low latency from cryptocurrency APIs to enable automated arbitrage, market making and other types of trades.

Use Case 2: Developing Analytical Models

Analysts rely on historical and live crypto price data from APIs to identify trends, create predictive models, backtest strategies, generate trading signals and so on.

These insights help analysts make judicious investment decisions and build products like trading indicators, market surveillance tools, portfolio optimization dashboards etc.

Example: Binance API

The Binance API provides market data on over 1000 cryptocurrencies from the Binance cryptocurrency exchange. This powers the development of trading bots, analytical models, portfolio trackers, market visualization dashboards and more.

Binance also offers additional APIs for spot trading, margin trading, futures trading, savings products, staking products and more.

3. NFT Data APIs

NFTs or non-fungible tokens allow ownership and exchange of unique digital assets. The global NFT market surpassed $40 billion in 2024.

NFT data APIs provide insights into NFT projects, ownership, sales, valuations, rarity analysis, collections and more. This powers NFT analytics, trading, fractionalization, lending and other emerging use cases.

Use Case 1: Building NFT Marketplaces

NFT marketplace developers integrate NFT data APIs to showcase NFT collections, token details, ownership records, bidding history and other data to users.

This brings transparency for buyers and sellers around aspects like provenance, demand, valuations etc. Popular NFT marketplaces like OpenSea and Rarible use NFT data APIs in this manner.

Use Case 2: NFT Investing and Trading Apps

NFT investing platforms connect to NFT data APIs to analyze price histories, trading volumes, ownership records, rarity metrics and other analytics. This powers data-driven investing, peer analysis and trading of NFTs.

Example: Blockdaemon NFT API

Blockdaemon‘s robust NFT API allows:

- Verifying NFT ownership on-chain – critical for community/gated NFTs.

- Browsing and exploring mainstream NFT collections like Bored Apes, CryptoPunks etc.

- Fetching analytics like rarity scores, activity metrics, valuations etc.

It can enable building NFT platforms for minting, trading, fractionalization, portfolio management, financing and more.

4. Smart Contract APIs

Smart contracts enable complex logic to be encoded on blockchains for conditional, automated execution.

Smart contract APIs provide easy integration of these self-executing programs into applications to enable automation of workflows.

Grand View Research estimates the global smart contract market will reach $345.4 million by 2030, at a CAGR of 17.7%.

Use Case 1: Supply Chain Optimization

Smart contracts can add transparency and automation to supply chain processes. Tracking inventory, orders, transit, payments etc.

APIs enable connection of smart contracts to existing enterprise systems like ERPs and CRMs for end-to-end supply chain automation and optimization.

Use Case 2: Insurance Claim Processing

Insurance policies can leverage smart contracts to automatically verify claims submitted and approve payouts based on coded logic and data inputs.

Oracles connect smart contracts with off-chain data like IoT sensor data, user inputs, and external APIs to trigger payouts.

Example: Chainlink API

Chainlink provides a robust smart contract API to connect to any off-chain resource like:

-

Vehicle telematics data from Tesla APIs.

-

Weather data from external weather APIs.

-

User identity/credentials via OAuth APIs.

It securely relays this external data on-chain to trigger smart contract execution based on real-world inputs.

5. Blockchain Payment APIs

Blockchain-powered payment networks like Bitcoin and Ethereum allow fast, global digital payments at a fraction of the fees charged by traditional networks.

Payment APIs make it easy to integrate cryptocurrency payment acceptance into online businesses and platforms without managing blockchain infrastructure.

The global crypto payments market is projected to grow from $3.4 billion in 2024 to $14.2 billion by 2027, per MarketsAndMarkets data.

Use Case 1: Accepting Cryptocurrency Payments

Online merchants use payment APIs to start accepting popular cryptocurrencies like Bitcoin, Ethereum, USDC directly on their ecommerce sites and apps.

This opens up a new customer segment and payment method without complex blockchain development.

Use Case 2: In-App Purchases

Gaming and software companies are using payment APIs to allow users to purchase in-app features, items, add-ons, using cryptocurrencies and NFTs.

For example, buying limited edition skins and upgrades in games with crypto. This enhances customer experience.

Example: Coinbase Commerce API

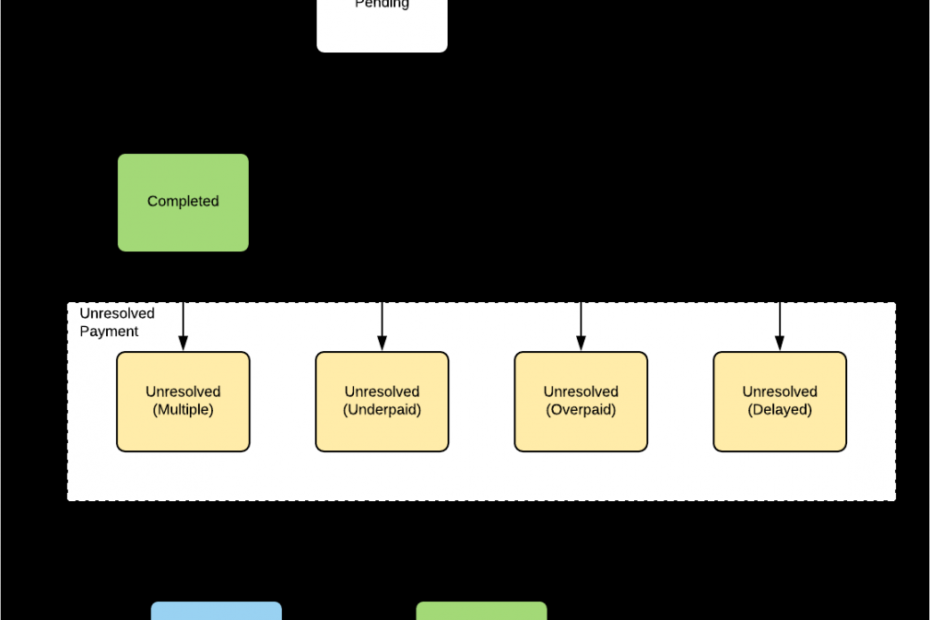

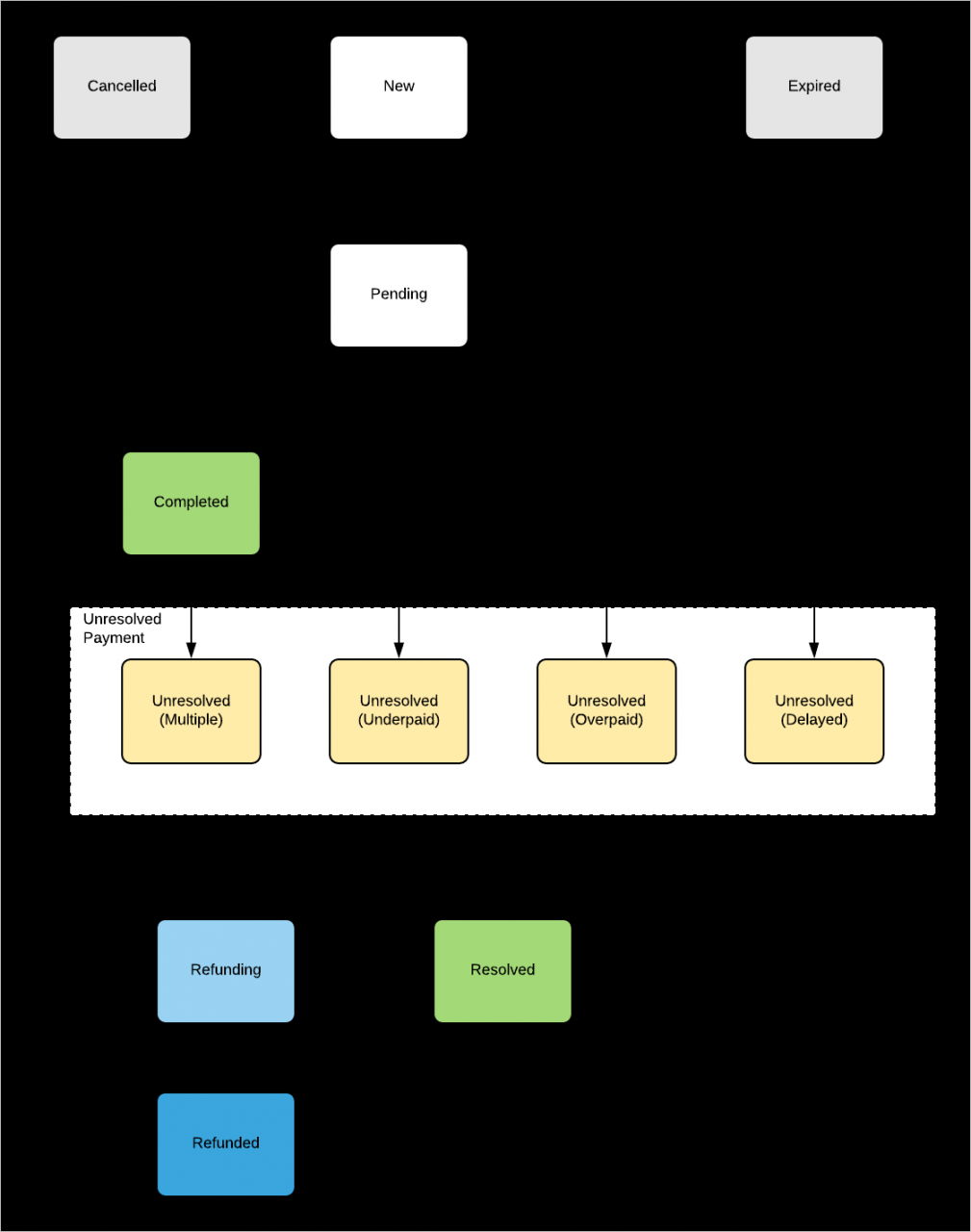

The Coinbase Commerce API powers acceptance of crypto payments including Bitcoin, Ethereum, USDC and more. Key features:

-

Easy payment address creation and lifecycle management.

-

Automatic payment notifications.

-

Streamlined transaction confirmation.

-

Protection from payment risks.

This simplifies integrating blockchain payments without operating blockchain nodes or infrastructure.

Coinbase Commerce API payment flow – Source: Coinbase Docs

Conclusion

Blockchain APIs provide simple integration of complex blockchain capabilities into products and services across industries – unlocking new revenue streams, automation, insights and experiences.

They enable businesses to tap into the multi-billion dollar blockchain opportunity without deeply investing in core protocol development. APIs open the doors to building innovative decentralized applications in a modular way.

However, it‘s key to rigorously test these APIs during development and monitor them in production for performance, security and availability.

Overall, blockchain APIs are accelerating blockchain adoption and digital transformation across sectors. They present a strategic opportunity for forward-thinking businesses to gain a competitive edge.

Want to explore leveraging blockchain APIs for your business needs? Let‘s connect and our blockchain experts can guide you in identifying the right solutions to drive impact and innovation.