Finance automation leverages the latest technological advances to optimize finance operations and processes. Rather than relying solely on traditional, manual methods for key areas like accounts payable and financial reporting, automation enables companies to radically streamline these activities to slash costs, accelerate processes, reduce errors, and improve efficiency.

According to a Forrester survey of finance leaders, 77% state business transformation relies on finance automation that provides real-time data and intelligence. With the rise of machine learning, robotic process automation (RPA), and other innovations, firms can automate a wide spectrum of finance tasks to unlock profound operational improvements.1

Interviews with leading companies implementing cutting-edge finance automation solutions reveal they can lower finance operations costs by ~70%, dramatically accelerate turnaround times, minimize errors, and reduce the need for human intervention by over 80%.2

The Top 6 Finance Processes Ripe for Automation

While practically any repetitive finance process is a prime candidate for automation, some of the top use cases include:

1. Order to Cash (O2C)

The order to cash process spans from receiving customer orders to collecting outstanding balances. Finance automation can streamline every step – from order management to invoicing, payment collection, credit management, and cash application. McKinsey estimates automating O2C can reduce costs by 20-40%.3

2. Payroll

Payroll includes processes like auditing timesheets, calculating deductions, correcting errors, and harmonizing data across timekeeping systems. RPA and AI automation can reduce payroll processing costs by 25-50% according to McKinsey.4

3. Source-to-Pay (S2P)

S2P encompasses procure-to-pay processes for requesting, procuring, receiving, and paying for goods and services. Accounts payable, purchasing, and invoice processing are prime sub-processes for automation, enabling cost savings of 45-70%.5

4. Financial Planning & Analysis (FP&A)

FP&A tasks ripe for automation include financial report generation, budget/forecast consolidation, and data collection/cleansing. This can boost FP&A productivity by 20-40%.6

5. Account Reconciliation

Highly repetitive account reconciliation activities like extracting data from ERPs, cross-checking balances, and creating standardized reports can be fully automated.

6. Period-End Financial Close

Key aspects of the financial close process – such as transaction sorting, general ledger reconciliation, and financial statement creation – can be automated to shorten close cycle times by 1-2 weeks.7

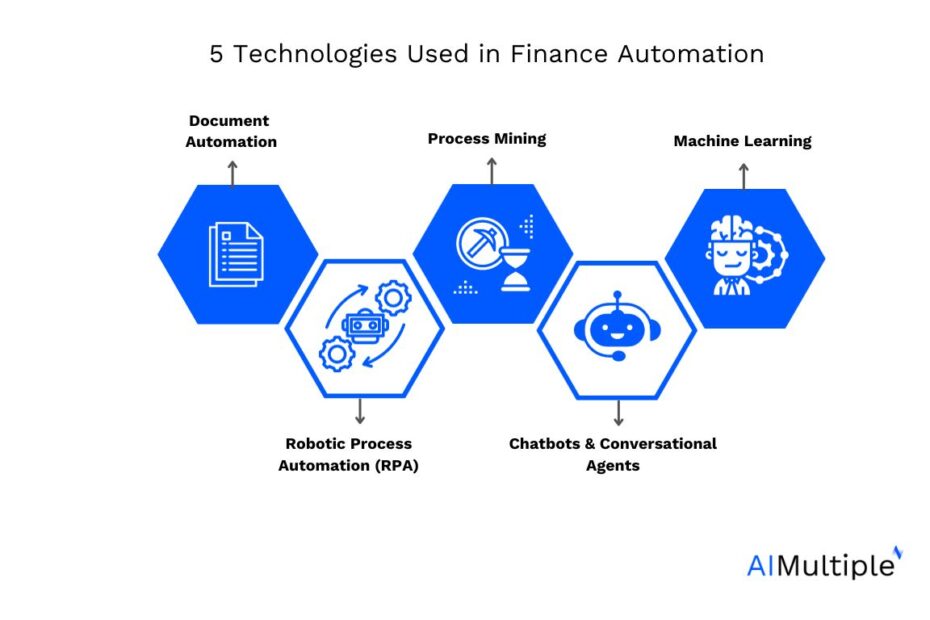

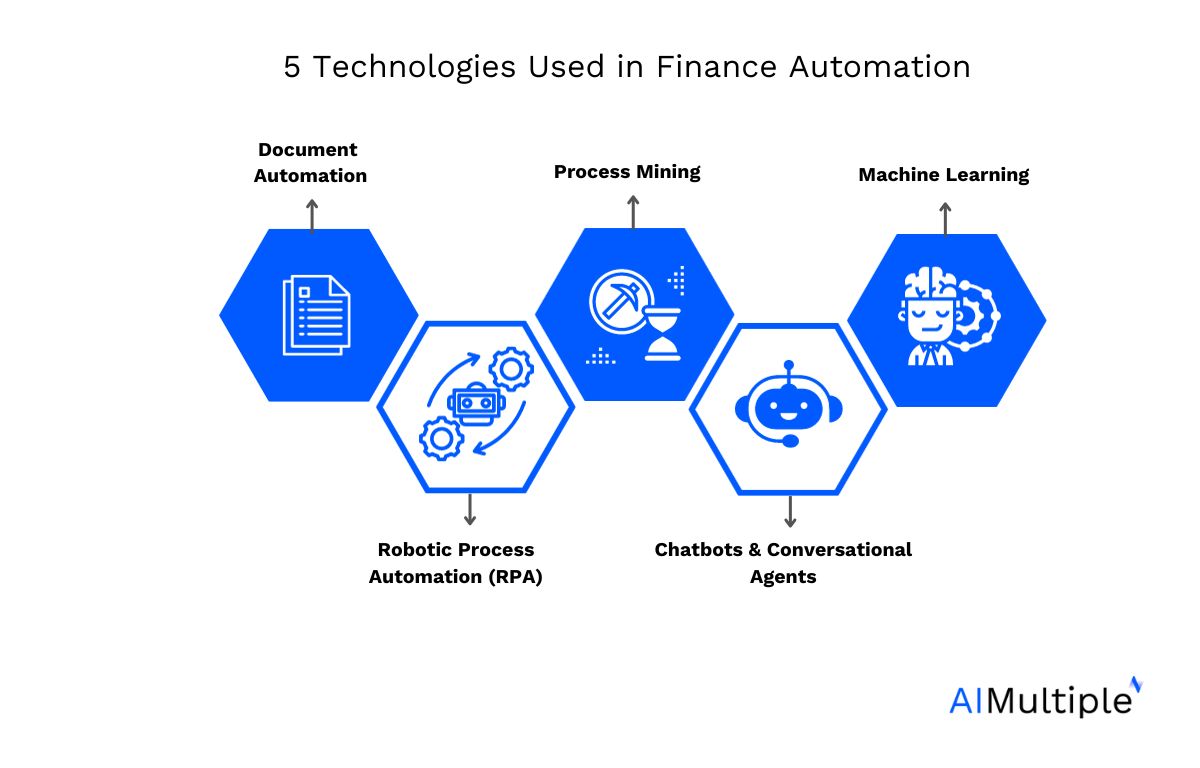

Finance Automation Enabling Technologies

There are a variety of technologies modern companies leverage to automate finance operations:

Document Automation

Document automation systems can auto-generate standardized documents like invoices and financial statements based on templates integrated with data sources. This can reduce document processing costs by 50-70%.8

Robotic Process Automation (RPA)

RPA bots automate repetitive, rules-based finance tasks by interfacing with multiple systems. This is helpful for automating cross-system workflows. RPA can deliver 200-300% ROI in finance when applied to suitable processes.9

Process Mining

Process mining analyzes actual workflows to identify automation opportunities and optimize processes. It provides objective insights to discover inefficiencies like bottlenecks.

Conversational AI/Chatbots

Virtual assistants that can handle frequent finance queries and requests using natural language conversations. They can reduce call volumes by up to 30%.10

Machine Learning

ML algorithms learn from past data to automate decision-making for forecasting, predictive analytics, and simulations. They can boost analytics productivity by up to 50%.11

The Benefits of Finance Process Automation

Automating finance processes and workflows delivers significant measurable benefits:

- Cost reduction: Invoice automation can lower invoice processing costs by 40-90% vs. manual methods.12

- Accelerated processes: AP automation can cut average invoice processing times by 80%.13

- Error reduction: Automation eliminates the manual errors inherent in human processing.

- Improved visibility: End-to-end audit trails vs. manual tracking provide transparency.

- Empowered employees: Automation lets staff focus on strategic, value-add activities.

- Enhanced analytics: Machine learning drives advanced forecasting and planning.

This graphic summarizes the potential efficiency gains and cost savings:

Overcoming Challenges With Finance Automation

While finance automation delivers immense benefits, some key challenges include:

Reluctance to Change Entrenched Processes

Companies are often hesitant to alter long-standing legacy finance processes. Fostering an automation culture and change management planning help overcome this hurdle.

Concerns Over Low ROI on Automation Investments

Automation solutions can require major upfront investments. But new vendors are innovating pricing models like consumption-based, outcome-based, and value-based pricing.14

Dependence on Process Standardization

Automation works best when processes are standardized vs. highly customized. Leading platforms are highly configurable to adapt to clients‘ existing processes and systems.

Overall, finance executives must strategically evaluate the considerable benefits versus addressable challenges of automation for maximum advantage. The efficiency gains and data-driven insights make finance automation an essential enabler for performance and value.

To explore automating your finance processes, please contact us. Our team would be delighted to advise and connect you with leading finance automation platforms.